Maryland Retirement Tax Elimination Act of 2023 - What You Need To Know

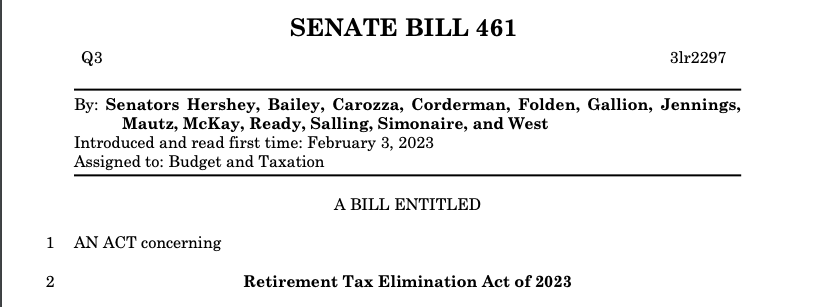

In a significant step towards recognizing the financial challenges faced by retirees, the Maryland General Assembly introduced Senate Bill 461, more commonly known as the Retirement Tax Elimination Act of 2023. This crucial piece of legislation aims to eliminate state income tax for certain segments of the population - those receiving old age or survivor Social Security benefits and those aged 65 and older who are not employed full-time. But what does this really mean for you as a retiree, or someone approaching retirement age? Let's dive into the details.

Overview of The Maryland Retirement Tax Elimination Act of 2023

First and foremost, it's important to understand the overall goal of Senate Bill 461. The legislation seeks to provide a subtraction modification against the State income tax for 100% of the income received by eligible individuals. In other words, the Act is designed to eliminate the state income tax for those who qualify under its provisions.

The Tax Exemption Phasing:

To ensure a balanced approach, the bill plans to phase in this tax exemption gradually over a span of six years, starting from the tax year 2023. During the initial years, the exemption has specific limits: starting from $10,000 in 2023, it increases by $10,000 each year until it reaches $50,000 in 2027. Come 2028, all income for eligible individuals will be exempt from state income tax.

Fiscal Impact

It's necessary to consider the fiscal implications of such a substantial change. The Maryland General Assembly forecasts that this new law will lead to a decrease in general fund revenues by an estimated $231.5 million in the fiscal year 2024, with this figure expected to rise annually until it reaches an estimated loss of $916.4 million by FY 2028. On the local level, revenues are expected to decrease by $171.9 million in FY 2024, reaching $653.1 million in FY 2028.

Importantly, the Assembly noted that this bill would not affect local expenditures or small businesses, maintaining economic balance across various sectors.

How Does The Retirement Tax Elimination Act Affect You?

The Retirement Tax Elimination Act of 2023 will undoubtedly have a significant impact on those eligible for its benefits. If you are currently receiving Social Security benefits, or are aged 65 and older without full-time employment, this Act essentially means more money in your pocket, easing the financial burdens that often come with retirement.

In addition to the existing tax relief measures for seniors, such as the Maryland Pension Exclusion and the Senior Tax Credit, the new bill will provide added financial comfort. By reducing or eliminating your state income tax liability, you'll have more financial freedom to enjoy your retirement, invest in healthcare, or support your family.

Phased Implementation:

Instead of an immediate total exemption, the Act employs a phased approach that gradually increases the value of the income tax exemption over a period of six years. Starting in tax year 2023, the initial subtraction modification or tax exemption will be $10,000. This means that the first $10,000 of your income won't be subjected to state income tax.

This amount will increase by $10,000 each year until it hits $50,000 in tax year 2027. The Act aims to completely exempt the state income tax for eligible individuals from tax year 2028 and beyond. In other words, by 2028, the entirety of the income received by qualifying individuals will not be subjected to state income tax.

Impact on Current Tax Benefits:

Maryland already has a number of tax relief provisions for seniors in place. The Maryland Pension Exclusion, for instance, allows seniors of at least 65 years, or those who are totally disabled (or whose spouse is totally disabled), to subtract certain taxable pension and retirement annuity income from their gross income for the purpose of determining Maryland adjusted gross income.

There's also a Senior Tax Credit for residents aged 65 or older, whose federal adjusted gross income does not exceed certain limits. Social Security benefits and benefits received under the federal Railroad Retirement Act are completely exempt from the Maryland income tax. Moreover, individuals aged 65 and older may claim an additional exemption of $1,000.

The Retirement Tax Elimination Act of 2023 does not nullify these existing benefits. Instead, it works in addition to these provisions, offering more financial relief to senior citizens.

In essence, the Retirement Tax Elimination Act of 2023 can make a significant difference to the financial stability of seniors in Maryland, reducing the tax burden and potentially freeing up more income for healthcare, housing, and other necessary expenses in retirement. While the full exemption doesn't kick in until 2028, the incremental increases starting in 2023 can still provide meaningful tax relief to qualifying seniors.

Conclusion

While the full effects of the Retirement Tax Elimination Act of 2023 will unfold over the coming years, the Act's potential passage is undoubtedly a positive step towards providing greater financial security for retirees in Maryland. As we move forward, it's essential to stay informed about these legislative changes and understand how they impact your financial landscape. After all, a comfortable and secure retirement should be a reward for years of hard work and dedication. The Act applies to individuals who either receive old age or survivor Social Security benefits or are aged 65 and above and not employed full-time. If you fall into either of these categories, you are eligible for the tax breaks introduced by the Retirement Tax Elimination Act of 2023.

If you have more questions about this, please don’t hesitate to reach out to us today!